In the face of challenges, LANXESS still achieves good results in the second quarter of 2022

Latest News:

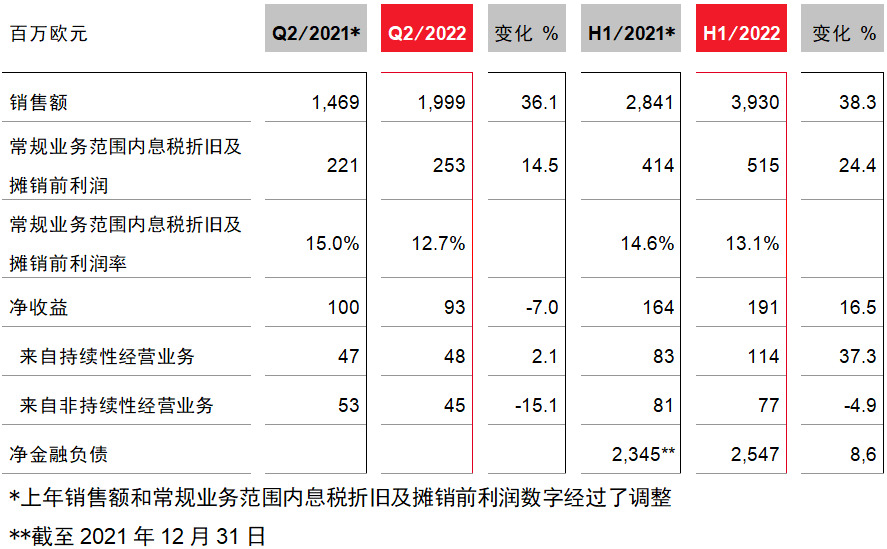

● Second-quarter sales rose 36.1% to EUR 1.999 billion

● EBITDA increased by 14.5% year-on-year to EUR 253 million

● Positive contribution from Emerald Kalama Chemical business acquired in 2021

● The High Performance Materials Business Unit is classified as a discontinued operation, and the previous year data on sales and EBITDA have also been restated accordingly

● Full-year forecast target: EBITDA in the regular business range of EUR 900 million to EUR 1 billion (previous year: approximately EUR 800 million)

In the severe situation of rising raw material and energy costs and difficult logistics conditions, LANXESS’s revenue increased again: In the second quarter of 2022, EBITDA in the regular business area reached 253 million euros, compared with 2.21 in the same period of the previous year. 14.5% higher than 100 million euros.

The Specialty Additives and Consumer Protection business segments experienced strong growth. The Consumer Protection business benefited significantly from the newly formed Flavors and Fragrances business unit. The business unit’s offerings include Emerald, a US company acquired in 2021

Kalama Chemical’s specialty chemicals for consumer products.

In the second quarter, LANXESS once again offset soaring raw material and energy costs by sharply raising its selling prices. Changes in exchange rates also had a positive impact on revenue development across all business segments. Continued difficult logistical conditions and high freight costs resulted in lower sales volumes, hindering further revenue growth. The EBITDA margin in LANXESS’ regular business range was 12.7 percent, down from 15.0 percent a year earlier.

Chang Mutian, Chairman of the Board of Management of LANXESS Group, said: “Despite the challenging situation, we remain firmly on track. The good second quarter results show that our strategic development is bearing fruit. Through the acquisition of Emerald

Kalama Chemical, we have significantly strengthened our consumer protection business segment and become more stable ourselves. In the second half of the year, the global economy will usher in greater storms, but we are ready. ”

In the second quarter, LANXESS sales were 1.999 billion euros, 36.1% higher than the 1.469 billion euros in the same period last year. Higher sales prices had a particularly positive effect. Net income from continuing operations was EUR 48 million, slightly higher than EUR 47 million a year earlier.

In May 2022, LANXESS announced the inclusion of the High Performance Materials (HPM) business unit in a joint venture with private equity investor Advent Ventures, so the business unit has been retrospectively confirmed as a non-commercial entity from January 1, 2022. Continuing operations, its sales and operating income, and prior year figures have also been restated accordingly.

LANXESS confirms and clarifies its guidance for a substantial increase for the full year 2022: LANXESS expects EBITDA in the usual range of EUR 900 million to EUR 1 billion. This corresponds to an increase of 25% compared to the adjusted level of around 800 million euros in the previous year.

Advancing strategic development

According to the plan, LANXESS has formed a joint venture with Advent Capital, which will further advance the strategic development of LANXESS. In addition to the LANXESS Performance Materials business unit, the joint venture for the production of high-performance engineering polymers will acquire the DSM Engineered Materials (DEM) business of the Royal Dutch DSM Group. After the deal closes as planned in the first half of 2023, LANXESS will receive a payment of at least 1.1 billion euros and a stake of up to 40 percent in the joint venture.

At the same time, LANXESS continues to strengthen its consumer protection business segment: As of July 1, 2022, LANXESS has completed the acquisition of the Microbial Control business of International Flavors and Fragrances (IFF). LANXESS has thus become one of the world’s largest suppliers of microbiological control products.

Business Segment: SalesHigh PriceIncrease DriveIncrease in Sales

After announcing the spin-off of the Performance Materials business unit, LANXESS now divides its business into three Specialty Chemicals business segments: High-Quality Intermediates, Specialty Additives and Consumer Protection.

Sales in the High Quality Intermediates business segment increased by 26.0% to EUR 587 million from EUR 466 million in the same period last year, as LANXESS offset higher raw material and energy costs through higher selling prices . Earnings before interest, tax, depreciation and amortisation in the regular business area fell by 18.7% to EUR 74 million from EUR 91 million a year earlier. The impact of the partial increase in raw material and energy prices was passed on to customers only after a period of time. Difficult logistics conditions combined with higher freight costs and lower volumes negatively impacted revenue. Planned downtime for maintenance also had a negative impact, resulting in the regular business EBITDA margin falling to 12.6%, down from 19.5% a year earlier.

In the Special Additives business segment, LANXESS successfully passed on the impact of rising raw material and energy prices to the market, with sales increasing by 34.5% to EUR 764 million from EUR 568 million in the same period last year. Affected by the global logistics situation, the sales volume decreased. In the second quarter of this year, the business segment’s EBITDA in the regular business area reached 134 million euros, a significant increase of 50.6% compared with 89 million euros in the same period of the previous year. EBITDA increased from 15.7% to 17.5% in the regular business area.

In the Consumer Protection business segment, the newly formed Flavors and Fragrances business unit contributed particularly to the positive development of sales and revenue. However, sales declined slightly due to lower volumes due to difficult logistical conditions. Overall, sales in this business segment increased by 52.5% to EUR 558 million from EUR 366 million a year earlier. Earnings before interest, tax, depreciation and amortisation in the ordinary course of business amounted to EUR 90 million, 26.8% higher than the EUR 71 million in the same period of the previous year. The EBITDA margin in the regular business range reached 16.1%, down from 19.4% in the same period last year.